.avif)

Summary & Bio

Michael and I do a deep dive around Bitcoin on a number of fronts – his framework for Bitcoin as a store of value for your corporate Treasury, how it’s fared versus other assets (hint: it’s crushing them), time of entry and cost of entry into a position, allocation size…and a lot more.

We also hit on market size and where it’s potentially headed, whether to buy through a fund or buy Bitcoin directly, and a super deep dive on the dynamics that are driving price and the growth of Bitcoin network.

Finally, we talk about the overfixation on whether we’re in a Bitcoin “bull cycle” or not, why big banks will likely support Bitcoin, what’s in it for payment platforms such as Google Pay and ApplePay, and Bitcoin as the apex monetary asset as well as the first digital monetary network.

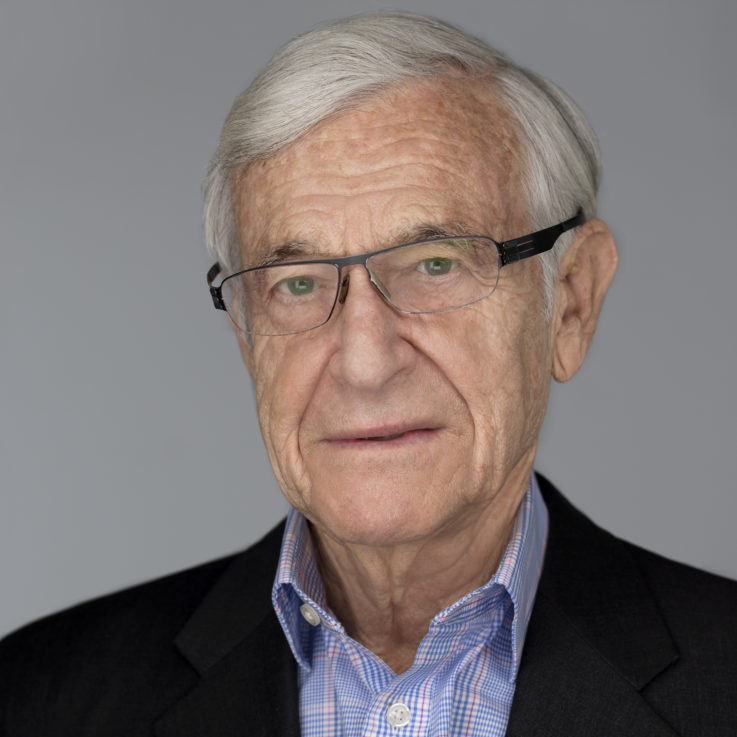

Michael’s Bio

Michael J. Saylor is an American entrepreneur, executive, inventor, author, and philanthropist. He was born to a military family in Lincoln, Nebraska, in 1965 and spent his childhood living on various U.S. Air Force bases around the world. By his teenage years, his family had settled at Wright-Patterson Air Force Base near Dayton, Ohio—the birthplace of aviation and home of the Wright brothers. He graduated from high school first in his class, served as both class marshal and valedictorian, and was voted most likely to succeed by his peers.

Mr. Saylor attended the Massachusetts Institute of Technology (MIT) on a full Air Force Reserve Officer Training Corps scholarship. While at MIT, he was a member of the Theta Delta Chi fraternity, and obtained dual degrees in aeronautics and astronautics as well as science, technology and society. In his free time, he played guitar in a rock band and learned to fly gliders. Mr. Saylor became fascinated by the application of computer simulation technology to public policy and business strategy, eventually writing his thesis “A Mathematical Model of a Renaissance Italian City State” while studying system dynamics at the MIT Sloan School of Management.

In 1987, Mr. Saylor graduated with highest honors from MIT. Having already successfully completed flight officer training at Lackland Air Force Base in San Antonio, Texas, where he learned to fly, he was commissioned as a Second Lieutenant in the United States Air Force. He joined the Air Force Reserve and began a career in consulting, with a focus on constructing computer simulations to support strategic decision-making at companies such as DuPont, Dow, and Exxon.

In 1989 at the age of 24, Mr. Saylor combined his passions for technology, business, and the use of computer simulations to launch MicroStrategy. The company was founded on his vision of helping enterprises deliver intelligence everywhere. By harnessing the power of graphical operating systems and client server computing, and pioneering a new approach to business intelligence called relational online analytical processing (ROLAP), the company grew steadily, going public in 1998 (NASDAQ: MSTR). Under his leadership, MicroStrategy has emerged as a global leader in enterprise analytics and mobility software, serving thousands of organizations around the world.

Mr. Saylor is a named inventor on more than 40 patents. In addition to being credited as the inventor of relational analytics, he led MicroStrategy into the fields of web analytics, distributed analytics, mobile analytics, cloud computing, mobile identity, and IoT. He was also the creator and founder of Alarm.com (NASDAQ: ALRM), one of the first home automation and security companies, and Angel.com (sold to Genesys Telecommunications Laboratories for $110 million in 2013), one of the first cloud-based interactive voice response service providers.

Mr. Saylor is the author of the book The Mobile Wave: How Mobile Intelligence Will Change Everything, published by Perseus Books in 2012. The book anticipated the impact of mobile, cloud, and social networks on worldwide political and economic development, along with the rise of Apple, Amazon, Facebook, and Google as transnational technology leaders that would destabilize the status quo across most industrial and political domains. The Mobile Wave appeared on both The New York Times and The Wall Street Journal Best Seller lists.

In 1999, Mr. Saylor established The Saylor Foundation, which has donated millions to philanthropic causes including children’s health, refugee relief, education, environmental conservation, and support for the arts. The foundation runs the Saylor Academy (Saylor.org), which offers free college education and continuing professional development courses to students worldwide. To date, it has provided free educational services to more than 650,000 students. In both 2015 and 2016, Mr. Saylor participated in the Forbes 400 Summit on Philanthropy.

Mr. Saylor travels 175,000 miles per year to more than 60 cities and 25 nations to share his perspectives on enterprise analytics and mobility with technology and business audiences. Throughout his travels,

he engages companies, organizations, and governments to discuss the ways that MicroStrategy can help them realize the vision of intelligence everywhere.

Listen to the episode on Apple Podcasts, Spotify, Stitcher, Google Podcasts, Overcast, Castbox, or your preferred podcast platform.

Notes

7:50 - Michael’s framework

The 10 year compounded growth of various asset classes - BTC 199% over a decade, gold 1.8%, S&P 11%, NASDAQ 16% and long dated treasuries 4%

The cost to capital tripled in March 2020 - traditional treasury strategy stopped working

The people who are most sensitive to this are those with huge amounts of cash available

Bitcoin is up 489% Gold is up 4% in last 8 months

11:20 What are you going to do if you have a billion dollars in cash?

You’re either going to lose 25% of the purchasing power by leaving it in cash (the conventional solution)

Or you’re going to dividend back by doing share buyback or decapitalizing (you have no capital)

You could attempt to buy ETFs or indexes (equity risk headaches)

Stocks as a store of value is a different instrument

BTC is clearly strongest money and apex monetary asset - it’s going up 200%/year and 400% this year

13:05 Are you trying to maximize shareholder value or attempting to put in place a hedge?

5-10% is a meaningful hedge

To maximize shareholder value, you would invest it all

There’s no point in trying to time the market

Look at the blue dollar of Argentina vs the US dollar

The stronger asset is going to continue to appreciate against the weaker asset

15:30 BTC should continue to appreciate until it becomes a $100 Trillion asset class

There’s no perfect time

You shouldn’t buy it unless you’re going to hold it for a decade

The parable of the Argentine rancher

Convert your Fiat cash flows into BTC

What is your forecast for the rate of monetary expansion in the currency of interest over the next decade?

19:30 The accounting treatment of BTC

If it’s important to get fair value accounting then you should invest a portion into a fund

If it doesn’t matter - the highest option is to buy the underlying asset

21:30 They buy a fund

No one is holding their private keys at an institutional level

23:13 The market is becoming more efficient

BTCC BTF Fund in Canada

More options coming online to get BTC exposure

24:20 Isn’t a question of strongest currency, it’s a question of strongest asset

Gold is paying 1.8% interest

BTC is 199%

It all comes down to it appreciating against the currency

If an asset is going to hold value and collapse a currency environment

28:55 The strongest asset class is virtual gold that you can move at the speed of light, that you can program at a million transactions a second that is open to everyone on Earth

A truly global network with a truly deflationary asset that you can’t make any more of - seems like God’s gift

That has all the advantages of big tech - with all advantages of gold with none of the disadvantages of gold

Someone doing something you can’t do anywhere on Earth is benefitting your asset

33:00 3 dynamics driving price and growth of the network

Adoption in general

Technical utility - building BTC into their mobile apps

A billion people with BTC on their mobile device in the next 5 years

Monetary inflation in the currency frame of reference

The inflation rate is a catalyst and a measuring stick

Capital is monetary energy - mass has monetary attraction - Newton’s law

36:35 There’s an overfixation on the “bull cycle”

He doesn’t believe it’s relevant

What happens when all the BTC miners go public and stop selling BTC, and start purchasing?

The logical thing for an investor - wouldn’t you value a publicly traded BTC miner more if they kept their BTC?

Once you go public - the stock to flow goes negative

39:45 If big banks don’t support BTC they lose all their capital and all their customers

BTC is a material competitive advantage to big tech

The war between Google, Apple and Facebook will be won by who stores your photos the best? Or who stores your money the best?

44:15 BTC is the apex monetary asset and the first digital monetary network

It remakes the entire finance industry

It remakes the entire big tech industry

Some companies will embrace it and build it into their funds or their tech

Some will choose not to

Those that choose to will be plugging into a global market growing at 200% per year

46:00 Everything other than BTC should be considered a venture capital

BTC is a savings account

BTC is digital gold, other cryptos are pursuing different use cases

47:15 The more you understand it, the higher the allocation goes

If you understood it but are still skeptical, invest 5-10%

The monetary policy makes it difficult to find monetary investments

Bonds don’t work as a store of capital

Real estate investments have API caps

51:25 If I increase my money supply by a factor of 10, will the thing that I own still have value?

If it’s a hard asset, and you can answer yes to that question - then it’s a good investment

It all comes down to how optimistic or pessimistic you are

52:35 His contrarian view

BTC is by far by a factor of 10 or more the best asset in the world

You’re wasting your time engaging in anything else in your life other than buying BTC or figuring out how to buy more BTC

Just buy BTC

Buy more BTC

Leverage up to buy more BTC- sell your gold, mortgage your house to buy more BTC

55:05 What’s on his browser?

Thecasebitcoin.com

Mainstream media

Mainstream finance journals - WSJ, etc.

Macroeconomic thinkers on Twitter

YouTube – great source for information

Featured Episodes

.svg)

.svg)

.png)

.jpeg)

.jpeg)